1. What are DLCs?

To understand what DLCs are, first, let’s break up the name “Daily Leverage Certificates” into its individual words:

- Certificate – means it is a financial product that replicates the performance of the Underlying Asset

- Leverage – means it gives investors an amplified exposure of the price movement of the Underlying Asset

- Daily – means its performance is calculated based on daily closing price of the Underlying Asset

In other words, DLCs allow you to trade an asset (index or single stock) without directly owning the asset.

You can express your view by buying the Long DLC if you think the price will go up, or buying the Short DLC if you think the price will go down.

By buying the DLC, you participate in the price movement of the asset, and your return is multiplied by a fixed factor (3, 5, or 7 times).

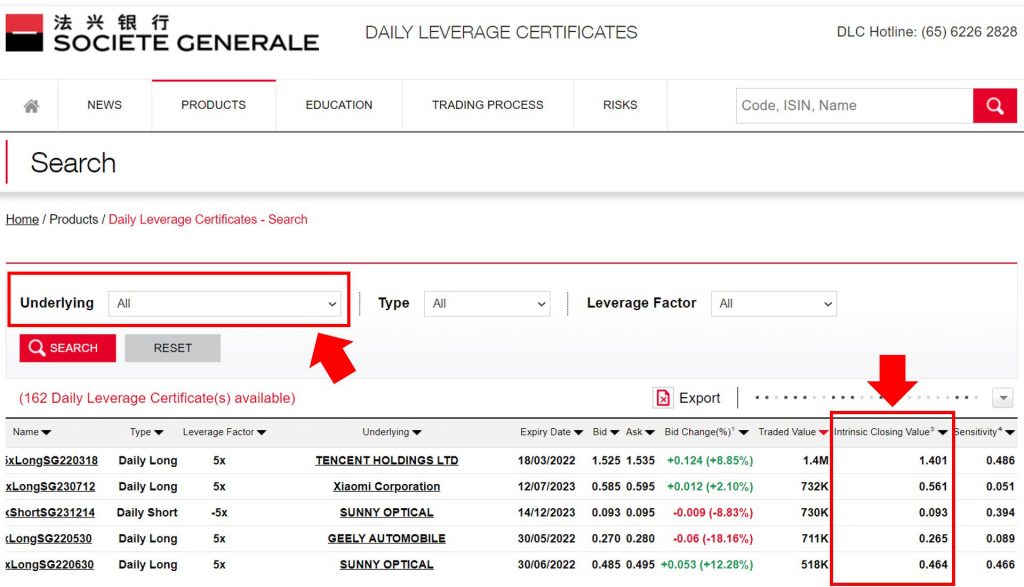

The performance of the DLC is calculated based on the “Intrinsic Closing Value” (explained below) of the DLC, published on SocGen website, not its last traded price.

2. What are the Advantages of Trading DLC Compared to Trading their Underlying Assets?

Advantage #1: Outsized return with limited capital

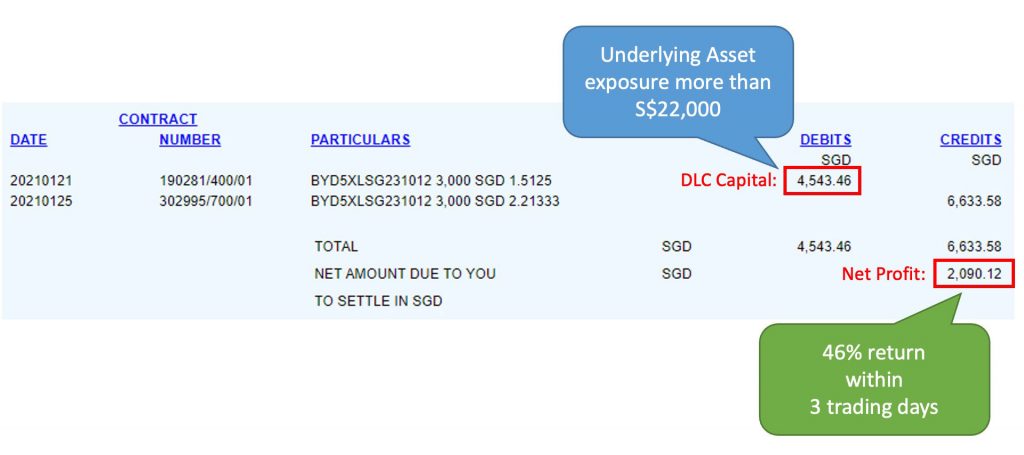

Refer to Figure 1, an actual trade of BYD 5x Long DLC.

With capital of S$4543.46, this trade managed to attain a net profit S$2090.12 (46%). To have the same exposure by buying BYD stocks directly, the capital required would be more than S$22,000.

Advantage #2: Access to HK listed Underlying Assets using SGD as Settlement Currency

The DLCs are all priced and settled in Singapore Dollars (SGD). However, many of the underlying stocks are Hong Kong listed stocks, like Tencent, Meituan, Geely and BYD.

If you trade primarily Singapore stocks, then your account funds are most likely in SGD. With DLCs, you can participate in the price movements of the Hong Kong stocks without needing to worry about currency conversion.

Advantage #3: Contra period by SGX

Since the DLCs are listed on SGX, investors will get to enjoy the T+2 settlement period (i.e. contra period) offered by SGX.

In addition to that, your broker may offer additional days for settlement for the trade done. For example, POEMS only asks for your funds on T+4 if you are not using a prepaid / margin account.

This means the if you get in and out of your trade within 5 trading days, you can essentially be trading with no upfront capital.

Advantage #4: Makes “expensive” stocks more accessible

Because the DLC is priced differently from the actual stocks, you can get exposure to these stocks with lower capital.

For example:

Tencent (0700.HK) is HKD$681.50 at the time of writing. If you were to purchase the Tencent stock directly, you will need a minimum capital of:

HKD$681.50 x 100 shares = HK$68,150 (approx. 12K SGD)

In comparison, the corresponding 5x Long DLC for Tencent (DANW) is S$7.909. When you use the DLC, the minimum capital required is:

S$7.909 x 100 shares = S$790.10

Advantage #5: No margin calls

In a traditional leverage instrument like CFDs, you typically put up at collateral and borrow money from the broker to fulfil your purchase.

For example:

If you want to purchase 1000 shares of DBS (CFD) at $26.00, the total investment is $26,000.

If the broker offers you a 10% margin, you will need at least 10% x $26,000 = $2600 as a collateral to fulfil the margin requirement.

If the price goes against you and DBS drops 11%, the losses incurred on your investment would then be more than the collateral. This is when you will get a margin call from your broker. You will then have to top up the required amount to fulfil the margin, or risk your shares getting force sold.

In contrast, the leverage for DLCs is factored into the price of the DLCs directly.

For example:

For a 5X Long DLC, the price movement is 5X that of the Underlying Asset. If the price of the Underlying Asset goes up 1%, the DLC should go up 5%.

Advantage #6: Transparent pricing

DLCs are exchange listed instruments.

This means that the pricing of the DLCs the same regardless of which broker you use for your investment. Your DLC purchase will also be lodged safely in your CDP account.

Advantage #7: Will not lose more than capital invested

Since the leverage for DLCs is factored into the price of the instrument directly, your maximum risk will be the initial capital invested, plus any fees.

3. How Do I Choose a DLC to Trade?

- Go to SocGen DLC home page

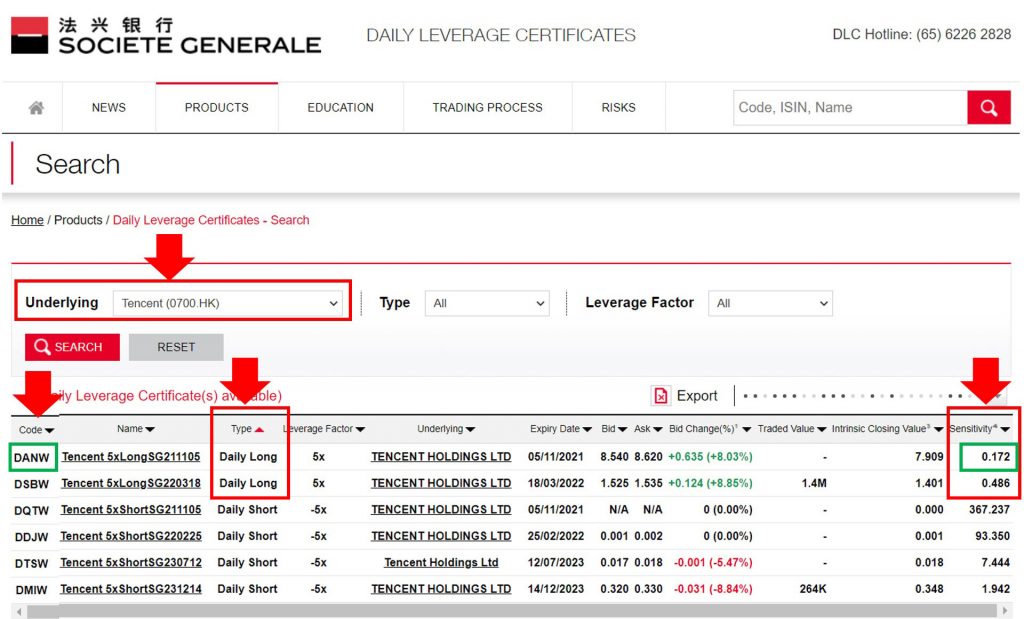

- Choose the Underlying Asset

e.g. Tencent - Choose the direction (Long or Short)

e.g. Long - Choose the leverage factor (3x, 5x 7x) for index, 5x only for stocks

e.g. 5x - Choose the most sensitive DLC available

Sensitivity measures how much the price of the Underlying Asset has to move to cause the DLC price to move by one tick. Hence, if the DLC is sensitive, a small movement of the underlying is able to cause a one tick move in the DLC. Thus, for the same direction and leverage factor, choose the DLC with the smaller sensitivity number.

e.g. DANW (sensitivity 0.486 < 0.172) - Add the stock code of the chosen DLC into your trading platform’s watchlist.

4. What is Intrinsic Closing Value?

It is price of the DLC at the closing time of the Underlying Asset the previous day.

As the time of last trade of the Underlying Asset may not coincide with the time of last trade of the DLC, there is a mismatch in what we are comparing. Hence the Intrinsic Closing Value is used to give a more accurate reference point to calculate the expected leverage return.

5. Can I Buy and Hold a DLC for Long Term Investment?

As DLC is a leveraged product, the effect of compounding can be a double-edged sword. Hence DLC is usually used for trend trading rather than long term investment.

When the market is clearly trending up, and the DLC is held longer than a day, the overall cumulative return of a long DLC should be better than the fixed leverage.

Example 1: Trending Market

Current price of a 5x leverage, Long DLC is $1, and the Underlying Asset price grows at 1% for 3 consecutive days, the DLC will grow 5% for 3 consecutive days with compounding.

Fixed leverage with compounding

- Day 0: DLC price = $1

- Day 1: DLC price = $1.05 (+5% to day 0)

- Day 2: DLC price = $1.1025 (+5% from day 1)

- Day 3: DLC price = $1.1576 (+5% from day 2)

Fixed leverage without compounding

- Day 0: DLC price = $1

- Day 1: DLC price = $1.05 (+$0.05 to day 0)

- Day 2: DLC price = $1.10 (+$0.05 to day 1)

- Day 3: DLC price = $1.15 (+$0.05 to day 2)

Thus, you can see that that effect of compounding resulted in an additional return of $1.1576 – $1.15 = $0.0076, or 0.66% in a trending market.

Example 2: Volatile Market

Current price of a 5x leverage, Long DLC is $1, and the Underlying Asset price falls 2% for 3 consecutive days, and then grows 2% for the next 3 consecutive days. Hence the DLC will fall 10% per day with compounding, and then rise 10% per day with compounding.

- Day 0: DLC price = $1

- Day 1: DLC price = $0.9 (-10% from day 0)

- Day 2: DLC price = $0.81 (-10% from day 1)

- Day 3: DLC price = $0.729 (-10% from day 2)

- Day 4: DLC price = $0.8019 (+10% from day 3)

- Day 5: DLC price = $0.88209 (+10% from day 4)

- Day 6: DLC price = $0.970299 (+10% from day 5)

You can see that even though the Underlying Asset is back to its original price after 6 days, the DLC is still down 2.7% from its original price of $1.

In other words, the effect of compounding eroded 2.7% from the value of the DLC after a volatile period, even though the price of the Underlying Asset is unchanged.

The two examples above are not meant to prove that DLC is good or bad. It just shows that you need to understand the nature of the product and use it to your advantage.

6. Is it Possible to Lose All My Money by Trading DLCs?

The simple answer is yes. However, you will not lose more than your initial capital.

Theoretically, for a 5x long DLC, a 20% increase in the price of the Underlying Asset within the same day will give you 100% return for the DLC. Inversely, a 20% drop in the price of the Underlying Asset within the same day will cause the DLC to lose 100% of its value.

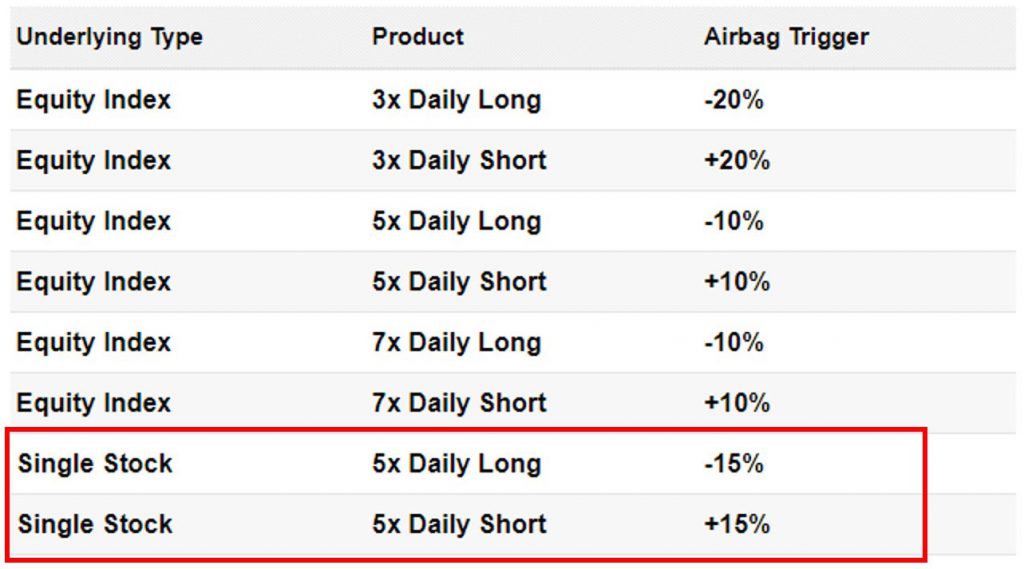

However, before the 20% mark is reached, the Air Bag Mechanism would have been triggered. Figure 4 shows the threshold of the movement of the Underlying Asset price that would trigger the Air Bag Mechanism.

Just like how the air bag in a car reduces the impact of the collision on the driver, the Air Bag Mechanism “cushions” the investor from the full impact of extreme market conditions when the price movement of the Underlying Asset adversely affects the DLC.

For instance, for a single stock 5x Long DLC, the Air Bag Mechanism will be triggered when the Underlying Asset price falls by 15%. Once the Air Bag Mechanism is triggered, the DLC enters into a 15-minute observation period. The lowest price in this 15-minute period is called the “new observed level”.

The DLC may or may not resume trading 30 to 45 minutes from the time the Air Bag Mechanism was triggered. If the DLC resumes trading, the leverage factor is applied to the new observed level to calculate the DLC price at which it resumes trading.

However, if the markets were then to bounce back, the Air Bag Mechanism would actually work against the investors, as it reduces the ability of DLCs to recover. This is due to the fact that the subsequent positive daily performance is now applied on a lower value (observed level) of the Underlying Asset.

There is no guarantee the Air Bag Mechanism will prevent investors from losing the entire value of their investment if the underlying continues to move beyond the airbag trigger.

7. Will DLC Price Fall on Ex-Dividend Date?

It depends. The DLC price is adjusted for the dividend.

On the ex-dividend date, if the:

- Underlying Asset price falls by same amount as dividend – there will be no change in DLC price

- Underlying Asset price falls more than dividend – the DLC price will fall

- Underlying Asset price falls less than dividend – the DLC price will increases

8. How Do I Get Approved to Trade DLCs?

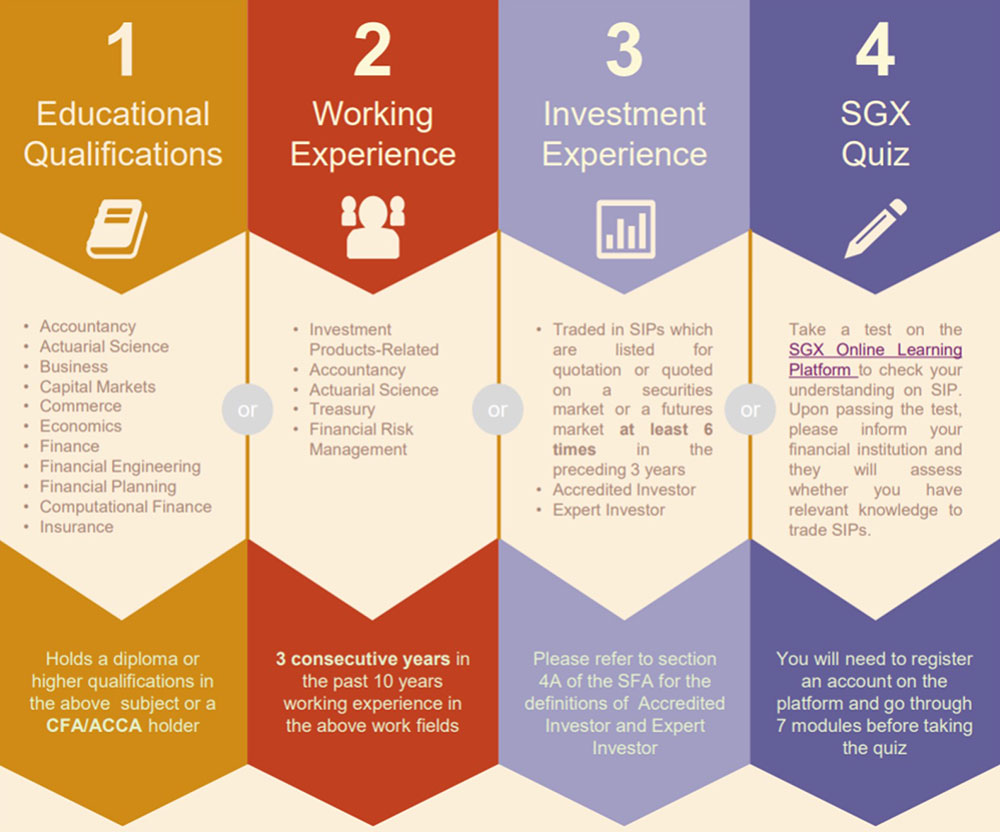

DLC is a Specified Investment Product (SIP). SIPs are financial products which may contain derivatives. Hence, investors need to meet one of the four criteria (Figure 5) before they are allowed to trade DLCs.

You may:

- Contact your broker to do the Client Account Review declaration or

- Take the quiz on SGX website and submit the certificate to your broker

Reference: https://dlc.socgen.com/

Investors can call SocGen’s DLC hotline – (65) 6226 2828 or email to [email protected].

* Disclaimer: All figures and calculations exclude commission and other fees. Trading with no upfront capital requires a margin provided by your broker.